Category: La Finca

-

Job Training: Will AI replace your job? Perhaps not in the next decade

To understand AI’s possible occupational implications, we explore the workforce effects of the last technological advance thought to put jobs at risk: computerization.

-

Codes Enforcement: NM Tax & Rev announces new tax and fee changes beginning July 1

For more information on 2025 legislative changes, see our YouTube channel and consider signing up for the New Mexico Taxation and Revenue Department Notification Service located on our News & Alerts page.

-

Picking Up Pieces: Resource event held for Job Corps participants affected by federal funding cut

New Mexico Job Corps has been a residential program, providing free education, training, and career development services to at-risk youth.

-

Government Contract: Applicants Sought for Wrecker Rotation Program

The completed application must be submitted to the Las Cruces Police Department’s Traffic Section no later than 5 p.m. Monday, June 23, 2025.

-

Extra Time: NM Environment Department extends timeline for workplace heat protection rule

NMED is seeking data from the medical and insurance providers related to heat illness and injuries in New Mexico.

-

Black Box: How Uncertain Is the Estimated Probability of a Future Recession?

In the United States, a number of predictive models for recessions rely on information from the term structure of interest rates based on Treasury bonds.

-

Loss of a Partner: What You Should Know About Social Security if Your Spouse Passes Away

Social Security benefits are based on a worker’s lifetime earnings.

-

verb–“to interrupt briefly”: U.S. Department of Labor Pauses Job Corps Center Operations

The pause of operations at all contractor-operated Job Corps centers will occur by June 30, 2025.

-

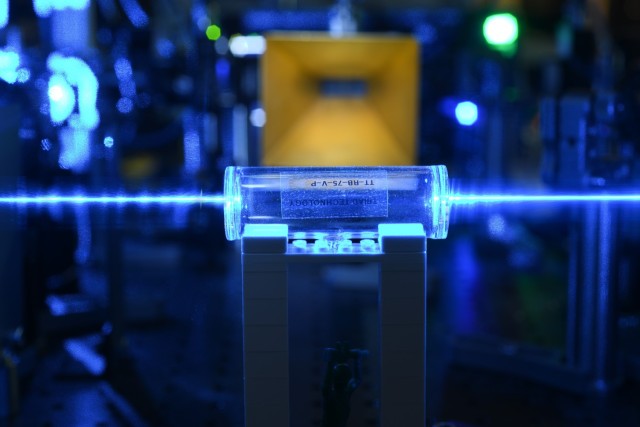

Leaps and Bounds: State seeks proposals for $25M investment in quantum technologies

Appropriated to the Economic Development Department during the 2025 legislative session, the funds align with the state’s focus on transforming New Mexico’s core competencies in quantum and boosting technological advancement, industry development, and regional, national, and international leadership.

-

Bringing It Home: Governor’s Travels Yield Results as NMexus (MEK-sus) Takes Root for All of New Mexico

The NMexus Center will equip companies from India, the Middle East, Europe, and Asia with the tools, knowledge, and networks necessary to successfully expand operations into New Mexico and succeed in the U.S. market.

-

“k” is for Crypto: US Department of Labor Rescinds 2022 Guidance on Cryptocurrency in 401(k) Plans

This language deviated from the requirements of the Employee Retirement Income Security Act and marked a departure from the department’s historically neutral, principled-based approach to fiduciary investment decisions.

-

Hope Emerges from Box: New Mexico AG Quick to Announce Trade Court Striking Down Tariffs

“The Worldwide and Retaliatory Tariff Orders exceed any authority granted to the President by IEEPA to regulate importation by means of tariffs.”

-

Keep Working: You May Be Able to Work and Receive Social Security Benefits

If you’re getting benefits now (or will in the future) and plan to work, you should understand these limits so you can avoid being overpaid.

-

Real Tests: Student Loan Delinquencies Are Back, and Credit Scores Take a Tumble

Millions of borrowers face steep declines in their credit standing which will increase borrowing costs or seriously limit their access to credit like mortgages and auto loans.

-

Mark of Approval: Postal Service Recognizes 250 Years of Army, Navy, Marine Corps With New Stamps

The three stamps, each featuring the name of the military service, the service seal and the inscriptions “250 Years of Service,” “Since 1775,” and “Forever/USA,” were revealed during a ceremony May 19 at Freedom Plaza in Washington.

-

Energy Industry Opportunity: Energy Innovator Fellowship Applications Open Through June 6

Candidates should have a demonstrated interest in energy solutions.

-

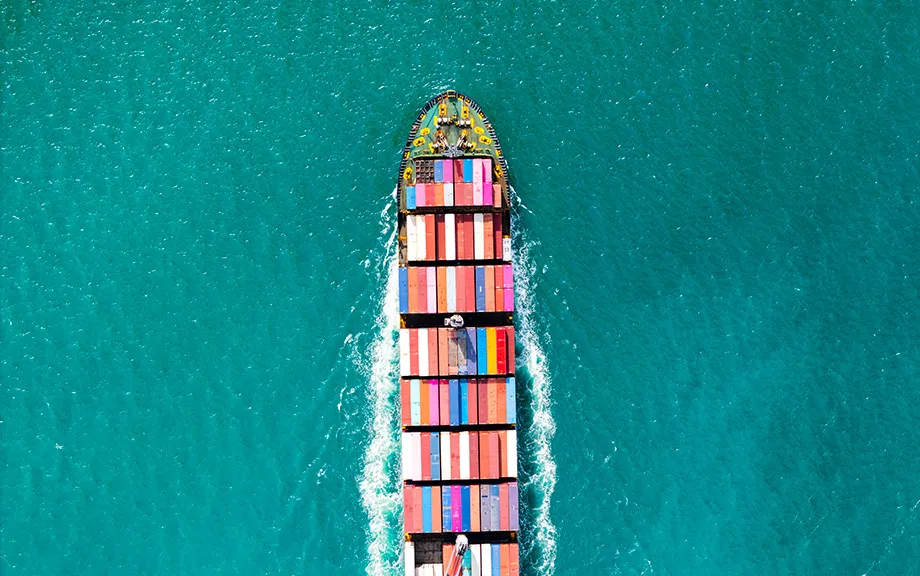

A Tangled Web: U.S. tariff outcomes dependent on trading partner responses

Modern models applied to the U.S. reveal that tariffs can enhance consumer welfare via terms-of-trade gains, a costly externality on foreign partners, but only if those partners don’t retaliate

-

Economics: Why Does the U.S. Always Run a Trade Deficit?

The imbalance reflects a macroeconomic phenomenon.

-

Throwing Eggs: Inflation Expectations Mixed; Financial Outlook for Households Deteriorates

Labor market expectations largely deteriorated in April, with households having lower expectations for both earnings growth and finding a job.

-

Matching Funds: Apply for Fiscal Year 2026 Small Business Innovation Research Grants–June 10 Deadline

This is a competitive grant for New Mexico for-profit technology companies with high-growth potential.

-

The College Economy: Educational Differences in Labor Market Outcomes

In this post, we document profound differences in labor market outcomes by educational attainment.

-

Foul Winds: Texas’ economic outlook deteriorates as tariff-related uncertainty builds

Job growth was solid in the first quarter. However, the Dallas Fed’s Texas Business Outlook Surveys (TBOS), which are timelier than government jobs data, point to broad-based weakening in business activity.

-

USDA Policy in Opinion Pages of NYT: “If You Want Welfare and Can Work, You Must”

Secretary Rollins issued a memorandum to all state agencies administering SNAP making it clear states must ensure SNAP benefits are provided with an expectation that those who can work, do.

-

Trickle Down: Department of Labor Visits Anheuser-Busch, McDonalds to Celebrate Major Investments

During a press conference Monday morning, Anheuser-Busch announced a $300 million manufacturing investment through its “Brewing Futures” initiative.

-

Destination: New Mexico selected as finalist for 2025 World Travel Awards

The selection of New Mexico as a finalist reinforces the state’s growing appeal as a top-tier travel destination and highlights the momentum building across the state’s vibrant tourism landscape.

-

Details: Telling the Story of the Nation’s Smallest Businesses

The three largest sectors in 2022 by number of establishments were Professional, Scientific, and Technical Services (4,013,209); Transportation and Warehousing (3,854,720); and Real Estate, Rental and Leasing (3,145,367).

-

Spacious Skies: February 2025 U.S. Airline Traffic Data Down 4.6% from the Same Month Last Year

When adjusted for seasonality, February enplanements are down 0.2% from January and down 2.6% from the all-time high reached in December 2024.

-

Buzzing: Special Operations Forces Week Conference Shines Spotlight on Latest Military Cash Cow

The 2024 edition attracted over 19,000 attendees–almost 7,000 more than Joint Task Force Southern Border has troops engaged in protecting the homeland.

-

Scrambled: The Market for Eggs; How Prices Are Hatched

Eggs have a surprisingly sophisticated marketplace, aptly named the Egg Clearinghouse, Inc. (ECI), where billions of eggs are traded every year.

-

![Peril: Recent Developments in Treasury Market Liquidity and Funding Conditions [a Speech]](https://lascrucesdigest.com/wp-content/uploads/2024/08/LSE_2024_ample-reserves_laspada_460.jpg.webp)

Peril: Recent Developments in Treasury Market Liquidity and Funding Conditions [a Speech]

[L]iquidity in Treasury cash markets became strained in early April, those markets continued to function, in part because of the resilience of funding liquidity in the Treasury repo market.

-

Ants in Industry: U.S. Census Bureau Resources, Data Tools, Website for Small Businesses

The SBA defines a small business as an independent one with fewer than 500 employees.

-

Big Money Leaving America: Credit Suisse Services AG Admits to Conspiring with U.S. Taxpayers to Hide Assets and Income in Offshore Accounts and Admits that Credit Suisse Breached Its Prior Plea Agreement

The guilty plea by the Swiss corporation is the result of a years-long investigation by U.S. law enforcement to uncover financial fraud and abuse.

-

Jobs: Veteran Unemployment Rate was 3.7% in April

In April 2025, the veteran unemployment rate was 3.7%, unchanged from the previous month and up from 3.2% the prior year.

-

True Opportunity: Tourism Department initiates new accessibility grant

This special grant opportunity is designed to help empower New Mexico communities to become inclusive and welcoming destinations and enhance accessibility for tourism in compliance with the Americans with Disabilities Act.

-

Inside a Navy-Certified Torpedo Repair Depot

The depot at Naval Undersea Warfare Center Division, Keyport, in Keyport, Washington, services lightweight and heavyweight torpedoes for all U.S. intermediate maintenance activities across the Navy.

-

How to Contact Social Security: What You Need to Know About Recent Changes

If you don’t have an account or access to the internet, you can contact us by phone, mail, fax, or in person.