Category: La Finca

-

Sunland Park: State training awards highlight continued growth in rural jobs

Each month, the JTIP Board meets to review applications for funding new hire training or upskilling current employees.

-

Minority Business Development Agency Makes Statement After Federal Funding Eliminated

The Business Resource Center, home to the Small Business Office and the former NM MBDA, remains open and operational.

-

Workforce Solutions celebrates National Apprenticeship Day with record growth

This milestone highlights New Mexico’s commitment to expanding career pathways and strengthening the workforce across industries ranging from traditional skilled trades to film and media to higher education and more.

-

![County Internship Program needs businesses to host students [Updated]](https://lascrucesdigest.com/wp-content/uploads/2024/07/County-News.png)

County Internship Program needs businesses to host students [Updated]

The program needs businesses, organizations or agencies to partner with the County.

-

Stablecoins and Crypto Shocks: An Update

As of March 2025, the market capitalization of stablecoins stood at $232 billion, up forty-five times since December 2019.

-

Trading Up: Reports from Around the World of Governor Lujan Grisham’s trade mission to Asia

The trade mission aimed to strengthen business ties, promote New Mexico’s leadership in advanced energy technologies and computing, and explore natural gas export opportunities.

-

USDA Ensures Illegal Aliens Do Not Receive Federal Benefits

The inadequate verification of an applicant’s identity and citizenship by states is specifically highlighted as contributing to the improper payments of SNAP funds.

-

Cost of Business: Walgreens Agrees to Pay Up to $350M for Illegally Filling Unlawful Opioid Prescriptions and for Submitting False Claims to the Federal Government

Walgreens will owe the United States an additional $50 million if the company is sold, merged, or transferred prior to fiscal year 2032.

-

Governor signs legislation to support infrastructure near military bases

Gov. Michelle Lujan Grisham has signed two bills strengthening New Mexico’s support for communities near military installations.

-

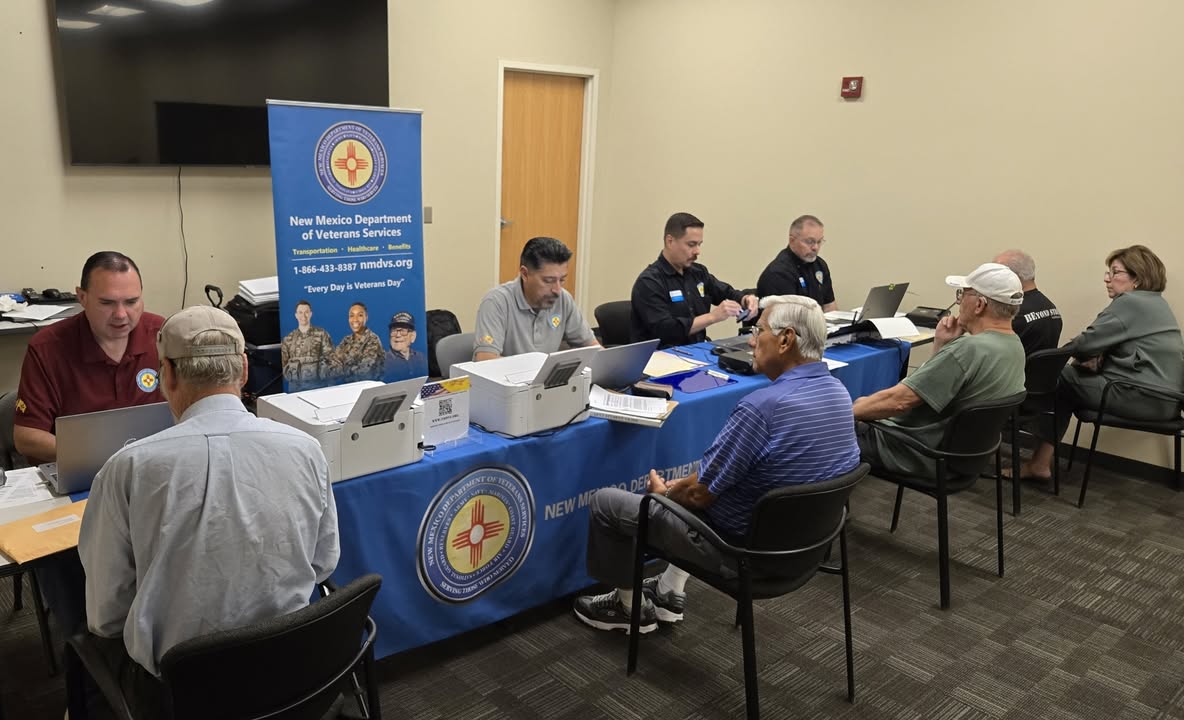

Tax Exemption: NM Department of Veteran’s Services Provide Assistance

House Bill 47 (HB47) recently implemented provisions of the constitutional amendments increasing veteran’s property tax exemption from $4,000 to $10,000

-

Essay Question: Is College Still Worth It?

In a two-part blog series, we offer an economic perspective on the value of a college degree, updating our previous research and analysis.

-

Kickstarter: Governor signs “shovel-ready” bills to boost business growth

Thirty-six U.S. states already have site-readiness programs, with outcomes proving this approach works.

-

Survey: Short-Term Inflation Expectations Increase, Labor Market Expectations Deteriorate

Stock price expectations declined and reached the lowest level since June 2022.

-

Register Now: Free Webinar on Immigration Changes and Your Business

The series is kicking off this Thursday, April 17, virtually over Zoom at 2:00 p.m. with “Immigration Changes and Your Business: What you Need to Know.”

-

NMSU students successfully complete side hustle course

The Construction Side Hustle course provided a structured, accessible entry point into entrepreneurship, particularly for those at the idea stage.

-

The Psychology of Free: How a Price of Zero Influences Decisionmaking

“The best things in life are free.” –Coco Chanel

-

Allen Theatres to Pay $250,000 in EEOC Class Age Discrimination Lawsuit Involving Health Benefit Plan

This alleged conduct violated the Age Discrimination in Employment Act (ADEA), which prohibits discrimination in the hiring, firing, and compensation of employees 40 years old or older because of their age.

-

Recent Shifts Seen in Consumers’ Public Policy Expectations

Households assign higher likelihoods to a variety of tax cuts and to reductions in a range of transfer programs, while they assign lower likelihoods to tax hikes and expansions in entitlement programs.

-

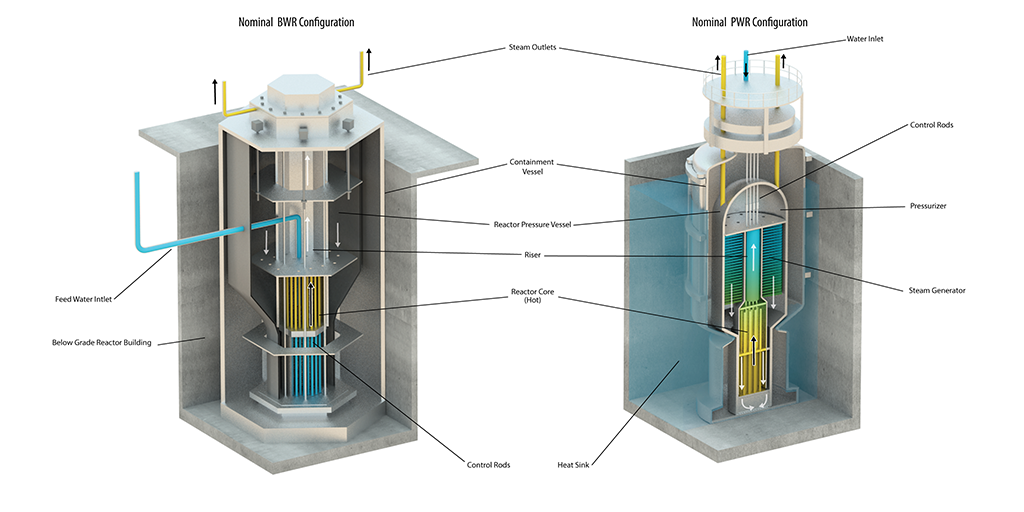

Advantages and Challenges of Nuclear-Powered Data Centers

Artificial intelligence and machine learning technologies require tremendous amounts of stable electricity generation, and some reports estimate that data centers could consume up to 12% of total U.S. energy production in 2028.

-

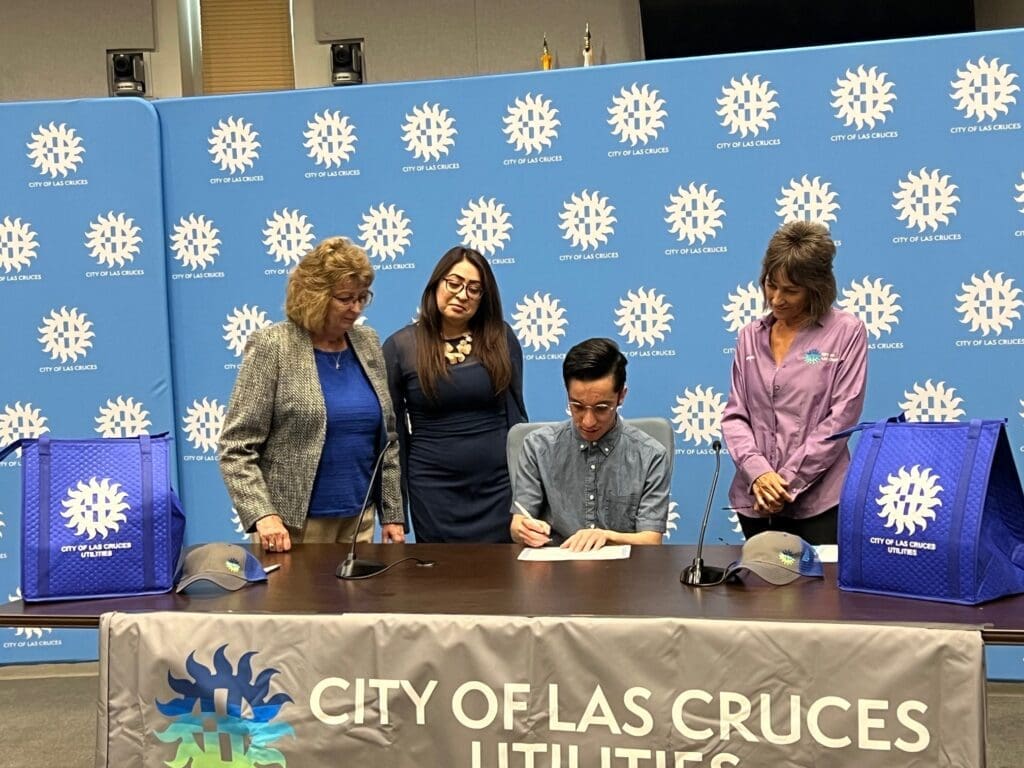

City of Las Cruces Utilities Internship Program Accepting Applications

The Las Cruces Utilities (LCU) Internship Program is a competitive program that awards internships to students pursuing an associate degree in one of the participating technology programs

-

Income Taxes for 2024 are due April 15

If the taxpayer has already filed, they can check their refund status using the “Where’s My Refund” tool on TAP—no account is needed. Refunds can take up to 12 weeks, though most arrive sooner.

-

Why Are Credit Card Rates So High?

Surprisingly, credit card interest rates are very high, averaging 23 percent annually in 2023.

-

Perspectives on public and private debt

Foreign central banks and investors also help absorb U.S. national debt. Their holdings doubled from about $4 trillion in 2010 to over $8 trillion in 2024.

-

Texas economic outlook downbeat as uncertainty increases

Company outlooks have deteriorated, and uncertainty has spiked, with half of TBOS respondents expressing concern about softening demand and a potential recession.

-

![Breaking: U.S. Announces Across the Board 10% Baseline Tariffs–Targeted Tariffs Higher [Entire Executive Order Included]](https://lascrucesdigest.com/wp-content/uploads/2025/04/Tariffs.png)

Breaking: U.S. Announces Across the Board 10% Baseline Tariffs–Targeted Tariffs Higher [Entire Executive Order Included]

For the first time in decades, the United States will see fair trade as President Donald J. Trump announces tariffs to level the playing field for American workers and businesses.

-

Two Years of Strong U.S. employment Driven by Sectors Less Sensitive to Business Cycles

The sectoral composition of employment reveals job growth has been concentrated in areas that are the least sensitive to national employment fluctuations over the business cycle.

-

Even a ‘miracle’ needs a safety net: Texas leads in growth, lags elsewhere

Household income in Texas has risen consistently, growing faster than inflation.

-

North American Transborder Freight Boomed in January, rising 8.2% year-over-year

Total transborder freight: $134.4 billion of transborder freight moved by all modes of transportation, increasing 8.2% compared to January 2024

-

Oil and gas activity edges higher; uncertainty rising, costs increase

The company outlook index decreased 12 points to -4.9, suggesting slight pessimism among firms.

-

New Mexico December Unemployment Unchanged from November

Within the private service-providing industries, private education and health services experienced a gain of 4,500 jobs, or 3.1 percent.

-

Fed President Williams Discusses “Certain Uncertainty”

After 30 years in central banking, I can unequivocally say: Uncertainty is the only certainty in monetary policy.

-

Manufacturing business to add 90 jobs to Borderplex region

This expansion is supported by the New Mexico Economic Development Department (EDD), which is providing economic incentives to help fuel job growth and workforce development in the region.

-

New Mexico Taxation and Revenue Department warns against scams and fraud

The Taxation and Revenue Department does not call individuals that have not already reached out to the department for assistance.

-

$900 Million Available to Unlock Commercial Deployment of American-Made Small Modular Reactors

U.S. electricity demand is forecast to soar in the coming years driven by consumer needs, data center growth, increased AI use, and the industrial sector’s need for constant power.

-

FinCEN Provides Responses to Frequently Asked Questions on Southwest Border Geographic Targeting Order Affecting El Paso Money Services

The GTO requires all money services businesses located in 30 ZIP codes across California and Texas near the southwest border to file Currency Transaction Reports with FinCEN at a $200 threshold, in connection with cash transactions.

-

Senior Defense Official Holds Backgrounder on Civilian Personnel Policies

Throughout this process, the department is ensuring that any employees impacted by the workforce reductions are treated with dignity and respect.