Category: La Finca

-

Social Security Administration Sets Record Straight: “the agency’s records are highly accurate”

Of the millions of death reports received each year, less than one-third of 1 percent are erroneously reported deaths that need to be corrected.

-

FBI Tells Citizens to “Slow Down” to Stay Safe from Scammers

Take precautionary measures to protect your identity if a criminal gets access to your device or account. Immediately contact your financial institutions to place protections on your accounts and monitor for suspicious activity.

-

NMSU VITA program continues free tax-filing assistance to community

Last year, the VITA program prepared a total of 204 federal income tax returns for the 2023 tax year and a total of 202 New Mexico income tax returns.

-

U.S. Treasury Issues Order Targeting Cash-Handling Businesses–Our Broader Community Overlooked, El Paso… not so lucky

The terms of the GTO are effective beginning 30 days after the date on which the order is published in the Federal Register.

-

Department of Defense Promotes Aircraft Boneyard As Model for Saving Taxpayer Dollars

Contractors shred the aircraft and sort through the shreds for aluminum, copper and exotic metals.

-

Veteran Unemployment Rate up to 4.0% in February–Department of Labor Says: “Hire a Veteran”

The unemployment rates are seasonally adjusted for individuals aged 18 years and over in the civilian non-institutional population.

-

Quartet of Tourism Department grant programs set to open for applications in March

These newer programs joined the long-standing New Mexico Clean and Beautiful Grant Program as the agency’s menu of grant funding options for tourism-related infrastructure and product development support.

-

State science and tech office announces contractors to provide startup business assistance, Advanced Energy: Arrowhead Center at NMSU makes list

The contractors were selected through a Request for Proposals that sought to award contracts to companies who, in conjunction with the Office of Strategy, Science & Technology (OSST), could provide tailored business assistance and one-on-one direct hours of support for businesses in the science and technology sector, including advanced computing, advanced energy, aerospace, bioscience, and…

-

New job training funds can assist up to 221 New Mexico workers–two local businesses get some assistance

The approved amounts for EDD’s signature Job Training Incentive Program (JTIP) can assist up to 170 new trainees and interns and 51 current employees. Companies that applied during these two months are located in Albuquerque, Las Cruces, Los Ranchos, Milan, Roswell, Santa Fe, Santa Teresa, and Taos.

-

Inflation Expectations Have Picked Up

Looking ahead, firms expect more significant cost increases in 2025.

-

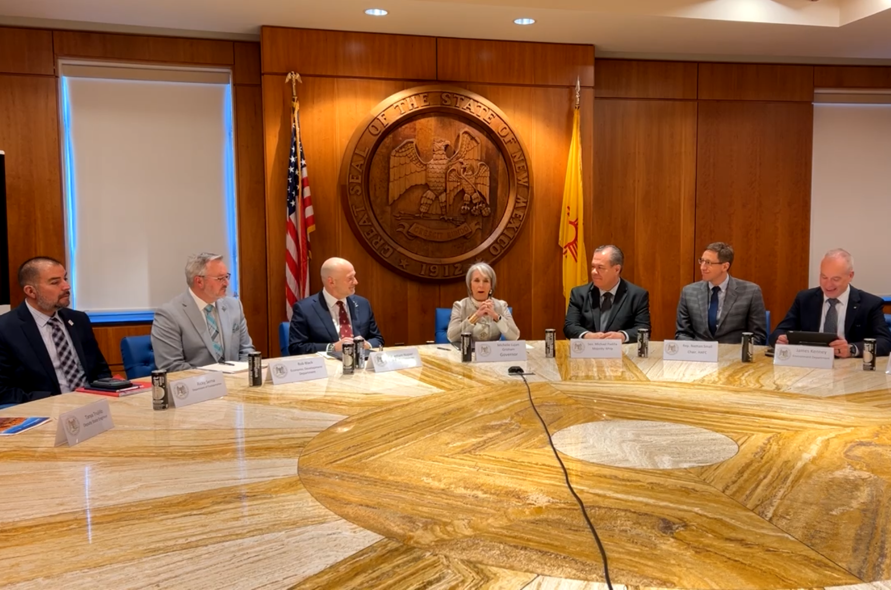

Investing in Our Broader Community: Governor Lujan Grisham announces $5 Billion partnership with BorderPlex Digital

Gov. Michelle Lujan Grisham announced today a partnership with BorderPlex Digital Assets, LLC that will position New Mexico as a leader in digital infrastructure to power the technology of tomorrow.

-

A Different kind of DoS at DoD: Probationary Workforce Statement

This re-evaluation of probationary employees is being done across government, not just at the Defense Department, but we believe in the goals of the program, and our leaders are carrying out that review carefully and smartly.

-

New Mexico announces statewide support for laid off federal workers

Workers separated from employment from the federal government, federal contractors, or federal grantees are encouraged to apply for Unemployment Insurance.

-

Social Security Slashes Cooperative Agreements and Gives DOGE “READ ONLY” Access to Social Security Data Not Protected by Specific Court Order

Terminating these cooperative agreements results in about $15 million dollars in cost savings for hardworking Americans in fiscal year 2025.

-

For “Slam the Scam Day”: Veterans Provided 7 Ways To Protect Themselves From Scams

Posing as employees of the Veterans Administration (VA), scammers contact veterans by phone, mail, email, and social media and offer to help them access or file for benefits on their behalf – for a fee.

-

Household Debt Balances Continue Steady Increase; Delinquency Transition Rates Remain Elevated for Auto and Credit Cards

The report shows total household debt increased by $93 billion (0.5%) in Q4 2024, to $18.04 trillion.

-

Geopolitical oil price risk not a major driver of global macroeconomic fluctuations

Oil supply risks have been widely considered among the top risks, reflecting uncertainty about OPEC quotas, access to Russian oil, widening conflict in the Middle East and disruptions of oil shipments.

-

Inflation expectations stable EXCEPT for gas, food, medical care, education, and rent ALL INCREASING; Household Spending Growth expectations DECLINE

The Survey of Consumer Expectations (SCE) contains information about how consumers expect overall inflation and prices for food, gas, housing, and education to behave. Source: Federal Reserve Bank of New YorkPhoto: Courtesy “The New York Fed DSGE Model Forecast—December 2024“, Liberty Street Economics, Federal Reserve Bank of New York NEW YORK—The Federal Reserve Bank of…

-

Bucket List Actions of the Last Independent Consumer Protection Agency: We’re On Our Own, Now

Regardless of how the agency is transformed going forward, it is clear that consumers should expect less to no assistance when faced with malfeasance and crimes perpetrated by our nation’s financial and corporate sectors.

-

New Mexico gets share of over $200 million in settlements and enforcement actions with Vanguard, Edward Jones and Block, Inc.

New Mexico’s Regulation and Licensing Department joined other states in securing settlements and an enforcement action totaling more than $200 million.

-

A Faster and More Convenient Way to Request a Social Security Number and Card

Do you need an original Social Security number or a replacement Social Security card?

-

Learn How to Protect Your Identity During Identity Theft Awareness Week

ID theft can happen to anyone, but you can take simple steps to lessen the chance it will happen to you.

-

State helps CBD processing plant expand in Estancia Valley: NewBridge to expand production operations in Estancia Valley

The New Mexico Economic Development Department and NewBridge Global Ventures (NewBridge) announced today that the Ag Tech company is planning a major expansion in the Estancia Valley to grow and integrate its farming, processing, manufacturing, and distribution businesses centered around industrial-scale hemp and CBD.

-

Center at NMSU to offer resources to new, established entrepreneurs in southern NM

Established business owners, as well as aspiring entrepreneurs, are invited to take advantage of programs resources offered by a new center located at New Mexico State University’s Arrowhead Center.

-

![Financial Stress Top 5: Delinquency Increasingly in the Cards for Maxed‑Out Borrowers [Fifth of 5]](https://lascrucesdigest.com/wp-content/uploads/2025/01/Screenshot-2025-01-18-at-12.57.03 PM.png)

Financial Stress Top 5: Delinquency Increasingly in the Cards for Maxed‑Out Borrowers [Fifth of 5]

In this post, analysts from the New York Fed’s Center for Microeconomic Data (CMD) explore the relationship between credit card delinquency and changes in credit card utilization rates.

-

![Financial Stress Top 5 of 2024: What Was Up with Grocery Prices? [Fourth of 5]](https://lascrucesdigest.com/wp-content/uploads/2025/01/Screenshot-2025-01-18-at-12.57.16 PM.png)

Financial Stress Top 5 of 2024: What Was Up with Grocery Prices? [Fourth of 5]

Taking a close look at the underlying data, the author suggests that the moderation in food inflation seen since 2023 is due to a retreat in commodity prices, a trend that has offset still-high wage inflation for grocery workers.

-

![Financial Stress Top 5 of 2024: Auto Loan Delinquency Revs Up [Third of 5]](https://lascrucesdigest.com/wp-content/uploads/2025/01/Screenshot-2025-01-18-at-12.57.35 PM.png)

Financial Stress Top 5 of 2024: Auto Loan Delinquency Revs Up [Third of 5]

High prices and rising debt put pressure on household budgets this year, so it’s little wonder that the most-read Liberty Street Economics posts of 2024 dealt with issues of financial stress: rising delinquency rates on credit cards and auto loans, the surge in grocery prices, and the spread of “buy now, pay later” plans.

-

![Financial Stress Top 5 of 2024: Dollar Assets, Gold, and Official Foreign Exchange Reserves [Second of 5]](https://lascrucesdigest.com/wp-content/uploads/2025/01/Screenshot-2025-01-18-at-12.57.54 PM.png)

Financial Stress Top 5 of 2024: Dollar Assets, Gold, and Official Foreign Exchange Reserves [Second of 5]

Global central banks and finance ministries hold an immense amount of U.S. dollar assets in their foreign exchange reserves, but the dollar’s overall share of those portfolios has decreased in recent decades.

-

![Financial Stress Top 5 of 2024: How and Why Do Consumers Use “Buy Now, Pay Later”? [First of 5]](https://lascrucesdigest.com/wp-content/uploads/2025/01/Screenshot-2025-01-18-at-12.58.04 PM.png)

Financial Stress Top 5 of 2024: How and Why Do Consumers Use “Buy Now, Pay Later”? [First of 5]

In this post, the authors shed light on the function of “buy now, pay later” (BNPL) plans in users’ household finances, focusing on how usage varies by level of financial fragility.

-

Inflation stress and concern remain elevated despite stabilizing prices

Although most economists and policymakers tend to focus on the decline in inflation (the change in prices), a large share of households—especially low-income households—remain focused on still-elevated prices and the resulting difficulties paying expenses.

-

![State of Consumer Risks 2025 Series: CFPB Takes Action on Bait-and-Switch Credit Card Rewards Tactics [Fifteenth of 15]](https://lascrucesdigest.com/wp-content/uploads/2024/12/Consumer-Risks-CFPB.png)

State of Consumer Risks 2025 Series: CFPB Takes Action on Bait-and-Switch Credit Card Rewards Tactics [Fifteenth of 15]

“Large credit card issuers too often play a shell game to lure people into high-cost cards, boosting their own profits while denying consumers the rewards they’ve earned.”

-

![State of Consumer Risks 2025 Series: CFPB Sues Walmart and Branch Messenger for Illegally Opening Deposit Accounts for More Than One Million Delivery Drivers [Fourteenth of 15]](https://lascrucesdigest.com/wp-content/uploads/2024/12/Consumer-Risks-CFPB.png)

State of Consumer Risks 2025 Series: CFPB Sues Walmart and Branch Messenger for Illegally Opening Deposit Accounts for More Than One Million Delivery Drivers [Fourteenth of 15]

Drivers had to follow a complex process to access their funds, and when they finally did, they faced further delays or fees if they needed to transfer the money they earned into an account of their choice.

-

![State of Consumer Risks 2025 Series: CFPB Files Lawsuit to Stop Illegal Kickback Scheme to Steer Borrowers to Rocket Mortgage [Thirteenth of 15]](https://lascrucesdigest.com/wp-content/uploads/2024/12/Consumer-Risks-CFPB.png)

State of Consumer Risks 2025 Series: CFPB Files Lawsuit to Stop Illegal Kickback Scheme to Steer Borrowers to Rocket Mortgage [Thirteenth of 15]

Rocket Homes pressured real estate brokers and agents not to share valuable information with their clients concerning products not offered by Rocket Mortgage, such as the availability of down payment assistance programs, which often save homebuyers thousands of dollars.

-

Number of Trucks Entering U.S. from Mexico Approaches 8 Million a Year: Bureau of Transportation Statistics Data Reveals Long-term Trend Emerging in North American Freight Trucking

Since 2000, the number of trucks from Canada have been decreasing while in contrast the number of trucks from Mexico have increased.

-

![State of Consumer Risks 2025 Series: CFPB Sues JPMorgan Chase, Bank of America, and Wells Fargo for Allowing Fraud to Fester on Zelle [Twelfth of 15]](https://lascrucesdigest.com/wp-content/uploads/2024/12/Consumer-Risks-CFPB.png)

State of Consumer Risks 2025 Series: CFPB Sues JPMorgan Chase, Bank of America, and Wells Fargo for Allowing Fraud to Fester on Zelle [Twelfth of 15]

The CFPB’s lawsuit describes how hundreds of thousands of consumers filed fraud complaints and were largely denied assistance, with some being told to contact the fraudsters directly to recover their money.

-

![State of Consumer Risks 2025 Series: CFPB Uncovers Illegal Practices Across Student Loan Refinancing, Servicing, and Debt Collection [Eleventh of 15]](https://lascrucesdigest.com/wp-content/uploads/2024/12/Consumer-Risks-CFPB.png)

State of Consumer Risks 2025 Series: CFPB Uncovers Illegal Practices Across Student Loan Refinancing, Servicing, and Debt Collection [Eleventh of 15]

The report covers violations related to student loan refinancing, private lending and servicing, debt collection, and federal loan servicing.