Category: La Finca

-

![State of Consumer Risks 2025 Series: the impacts of Social Security offsets on student loan borrowers [Tenth of 15]](https://lascrucesdigest.com/wp-content/uploads/2024/12/Consumer-Risks-CFPB.png)

State of Consumer Risks 2025 Series: the impacts of Social Security offsets on student loan borrowers [Tenth of 15]

When borrowers default on their federal student loans, the U.S. Department of Education (ED) can collect the debt. It can use forced collections, including tax refund and Social Security benefit offsets, and wage garnishment.

-

![State of Consumer Risks 2025 Series: CFPB Sues Experian for Conducting Sham Investigations of Consumer Report Errors [Ninth of 15]](https://lascrucesdigest.com/wp-content/uploads/2024/12/Consumer-Risks-CFPB.png)

State of Consumer Risks 2025 Series: CFPB Sues Experian for Conducting Sham Investigations of Consumer Report Errors [Ninth of 15]

Today, the Consumer Financial Protection Bureau (CFPB) sued Experian, the nationwide consumer reporting agency, for unlawfully failing to properly investigate consumer disputes.

-

Social Security Adminstration Suggests: Resolve to Protect Yourself From Scams This New Year

Take some time to review the privacy settings on your social media platforms and limit the amount of personal information you share publicly.

-

![State of Consumer Risks 2025 Series: CFPB Closes Overdraft Loophole to Save Americans Billions in Fees [Sixth of 15]](https://lascrucesdigest.com/wp-content/uploads/2024/12/Consumer-Risks-CFPB.png)

State of Consumer Risks 2025 Series: CFPB Closes Overdraft Loophole to Save Americans Billions in Fees [Sixth of 15]

The agency’s final rule on overdraft fees applies to the banks and credit unions with more than $10 billion in assets that dominate the U.S. market.

-

State of Consumer Risks 2025 Series: CFPB Takes Action Against Student Loan Debt Collector Performant Recovery for Illegal Fee Generating Scheme That Cost Borrowers Thousands of Dollars (Fifth of 15)

The CFPB found that Performant delayed borrowers’ loan rehabilitation processes, generating fees for itself and costing individual borrowers thousands of dollars.

-

State of Consumer Risks 2025 Series: CFPB Takes Action Against Climb Credit and Investment Firm 1/0 for Deceiving Borrowers About Coding Bootcamps and Vocational Programs (Fourth of 15)

The CFPB sued Climb Credit for offering loans for educational programs that often were not vetted for quality and job placement success or that failed the vetting, despite Climb Credit making representations to the contrary.

-

State of Consumer Risks 2025 Series: CFPB Announces Return of $1.8 Billion in Illegal Junk Fees to 4.3 Million Americans Harmed in Massive Credit Repair Scheme (Third of 15)

The Consumer Financial Protection Bureau (CFPB) is distributing $1.8 billion to 4.3 million consumers charged illegal advance fees or subjected to allegedly deceptive bait-and-switch advertising by a group of credit repair companies including Lexington Law and CreditRepair.com.

-

State of Consumer Risks 2025 Series: United States Files Complaint Against Dave Inc. and CEO Jason Wilk Alleging Deceptive Practices in Violation of Federal Law (Second of 15)

The Justice Department, together with the Federal Trade Commission (FTC), today announced a civil enforcement action against Dave Inc. (Dave) and its co-founder, President, Chief Executive Officer and Chairman of the Board of Directors, Jason Wilk, for alleged violations of the FTC Act and the Restore Online Shoppers’ Confidence Act (ROSCA).

-

State of Consumer Risks 2025 Series: Register before January 8th to join a free CFPB webinar on tax time resources for consumers (First of 15)

This webinar is designed for frontline service providers and program managers who want to know more about free filing options for the people they serve.

-

Social Security: Five Topics of Conversation for Holiday Gatherings

If the topic of Social Security comes up during a holiday get-together, we’ve put together 5 basic messages you can share with your loved ones.

-

The Tax Man is Catching Up with “Gig Economy” Workers

U.S. District Judge Dolly M. Gee for the Central District of California found that there is a reasonable basis for believing that U.S. taxpayers who were paid by JustAnswer to answer questions as experts may have failed to comply with federal tax laws.

-

The Most Wonderful Time of the Year for Many Businesses

Regardless of the holiday, food-sharing and family gatherings are all part of seasonal traditions.

-

X Marks the Spot: Making Missing Markets

“There is a high correlation between gaps and deficiencies, including those relating to climate, health, and economic investment.”

-

Inflation Expectations Decline Slightly; Labor Market Expectations Improve

Perceptions of credit access and expectations for future credit access both improved in October.

-

Consumers Report Higher Credit Rejection Rates, Expect Fewer Credit Applications

Households anticipate that they will be less likely to apply for at least one type of credit over the next 12 months.

-

Household Debt Rose Modestly; Delinquency Rates Remain Elevated

Mortgage balances increased by $75 billion from the previous quarter and reached $12.59 trillion at the end of September.

-

Artificial Intelligence Camera Captures Bird Behavior Around Solar Panels to Inform Siting and Conservation—Success Story

A team at Argonne National Laboratory set out to develop a camera system that could continuously monitor how birds behave around solar panels using artificial intelligence.

-

Apple and Goldman Sachs Ordered to Pay Over $89 Million for Apple Card Failures

Apple and Goldman launched Apple Card despite third-party warnings to Goldman that the Apple Card disputes system was not ready due to technological issues.

-

Unemployment Insurance Weekly Claims Report Update

In the week ending August 17, the advance figure for seasonally adjusted initial claims was 232,000, an increase of 4,000 from the previous week’s revised level.

-

A Driver Can Easily Get More Miles from an Hour of Level 2 Charging while their EV is Parked than the Average Person Drives in a Day

A driver can easily get more miles from an hour of level 2 charging while their light-duty EV is parked and plugged into a charger than the average person drives in a day.

-

NMSU Alumnus devotes career to helping others preserve and grow their finances

Wealth management professionals like New Mexico State University alumnus CJ Dennis devote their careers to helping others preserve and grow their finances.

-

The Federal Reserve and its Monetary Policy Implementation Framework

The Federal Reserve System is the central bank of the United States. Its key entities are the Board of Governors, which is an independent federal government agency, 12 regional Federal Reserve Banks, and the Federal Open Market Committee (FOMC).

-

Regulating Decentralized Systems: Evidence from Sanctions on Tornado Cash

Blockchain-based systems are run by a decentralized network of participants and are designed to be censorship-resistant.

-

NMSU to host 40th annual Career Expo, Engineering, Science and Technology Fair

New Mexico State University’s Office of Experiential Learning will host the 40th annual Career Expo Fair and Engineering, Science and Technology Fair from 9 a.m. to 2 p.m. Sept. 17-18.

-

Employment Opportunities as of Friday, August 16, 2024

Over the course of the past week, Las Cruces Digest received dozens of announcements of open positions, and employers hoping to fill them. To be sure, these are not all local jobs; however, these employers are casting a wide net in hopes of finding help. A Las Cruces Digest Report Disclaimer: The following links and…

-

New Good Jobs in Clean Energy Prize Gets to Work– Department of Energy Offering Over $3 Million to Create Clean Energy Jobs

DOE’s new Good Jobs in Clean Energy Prize will award over $3 million to new or existing place-based coalitions focused on creating accessible, good-paying jobs in clean energy.

-

Unemployment Insurance Weekly Claims Report 08/15/2024 08:00 AM EDT

In the week ending August 10, the advance figure for seasonally adjusted initial claims was 227,000, a decrease of 7,000 from the previous week’s revised level.

-

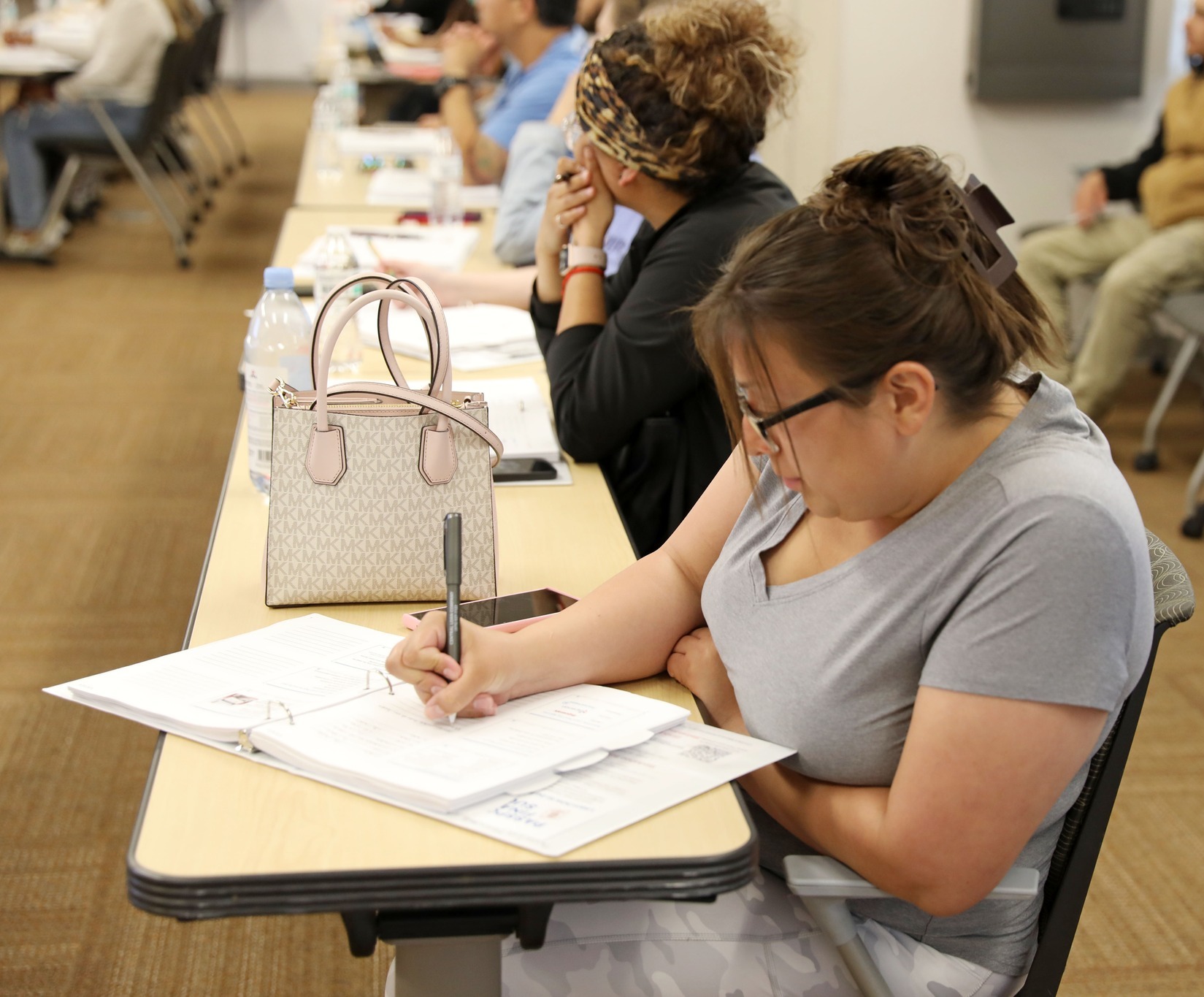

Learn to be financially Savvy with the City of Las Cruces and the United Way of Southwest New Mexico.

Join the FREE 6-part financial literacy program to learn the basics of finances through a range of class topics.

-

Unemployment Insurance Weekly Claims: New Mexico had 799 New Claims with 10,000 still looking for work

Nationally, the advance seasonally adjusted insured unemployment rate was 1.2 percent for the week ending July 27, unchanged from the previous week’s unrevised rate.

-

Employment Opportunity Roundup: August 9, 2024

Over the course of the past week, Las Cruces Digest received dozens of announcements of open positions, and employers hoping to fill them. To be sure, these are not all local jobs; however, these employers are casting a wide net in hopes of finding help.

-

Arrowhead Center at NMSU to host state’s first Startup World Cup competition in Albuquerque

New Mexico has been selected to join the 2024 Startup World Cup, a prestigious global competition organized by San Jose, California-based Pegasus Tech Ventures, offering a $1 million prize to the winner.

-

Demographic Characteristics of Nonemployer Business Owners

This release also includes business owners’ urban and rural classification, receipt size of firm, legal form of organization (e.g., sole proprietorships and partnerships), and for the first time, tabulation of nonemployer business data by county.

-

Trade liberalization reduces entrepreneurship rate

Entrepreneurship is an extremely important driver of economic growth and wealth creation. However, entrepreneurship opportunities may be significantly different in a globally interconnected economy relative to the past.

-

The Anatomy of Labor Demand Pre- and Post-COVID

Has labor demand changed since the COVID-19 pandemic? The authors leverage detailed data on the universe of U.S. online job listings to study the dynamics of labor demand pre- and post-COVID.

-

Study shows NM outdoor recreation businesses expect growth–Grants Available

The New Mexico Economic Development Department’s Outdoor Recreation Division (ORD) Director Karina Armijo announced the opening of both the Outdoor Equity Fund (OEF) and the Outdoor Recreation Trails+ Grant. Both grant programs opened for applications on July 1, 2024.

-

Las Cruces Reads about Money Tech: The DeFi Intermediation Chain

Decentralized finance, or DeFi, is a rapidly growing ecosystem of financial applications built on blockchain technology, primarily on the Ethereum network.