-and-

Veterans with a service-connected permanent and total disability rating of 100% waives property tax payment of their primary residence.

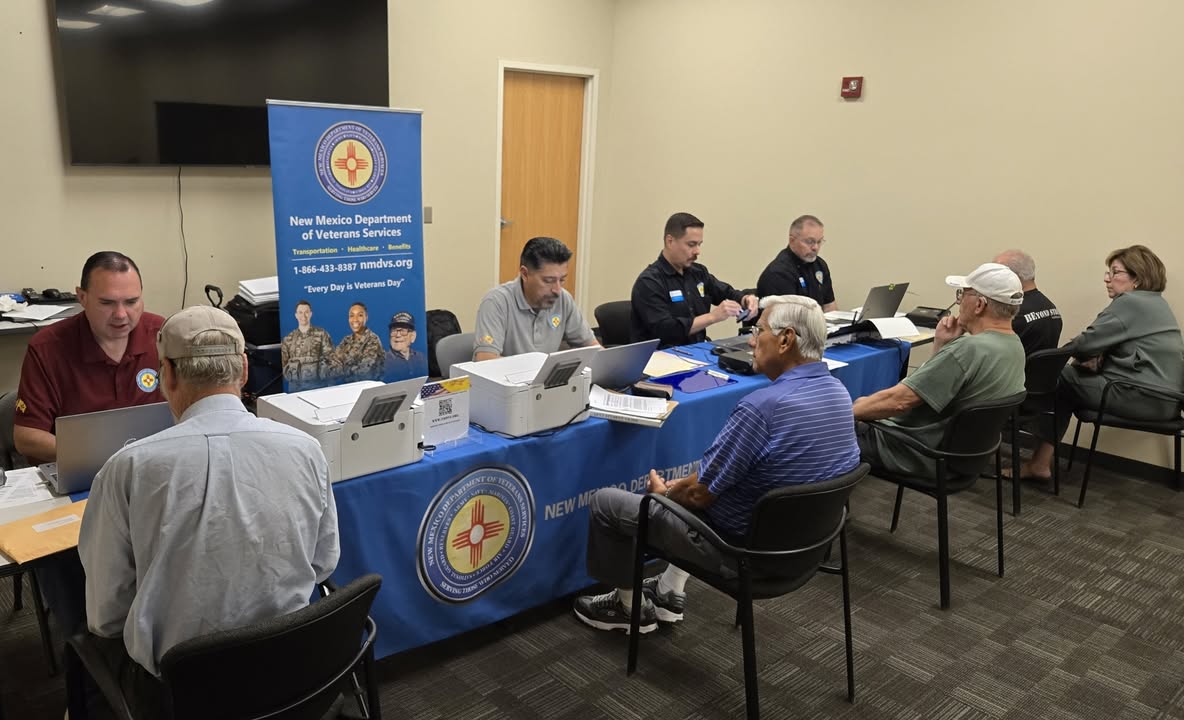

Source: Doña Ana County Government Center (via Facebook)

Photo: Courtesy

The New Mexico Department of Veterans’ Services assisted 164 veterans receiving their property tax exemptions in Doña Ana County.

House Bill 47 (HB47) recently implemented provisions of the constitutional amendments increasing veteran’s property tax exemption from $4,000 to $10,000 and allowed a proportional property tax exemption equal to the percentage of service-related disability.

Veterans with a service-connected permanent and total disability rating of 100% waives property tax payment of their primary residence.